It has been three years since the last Australian Shopper Marketing industry benchmark survey was conducted.

It has been three years since the last Australian Shopper Marketing industry benchmark survey was conducted.

In that time there’s been much talk of digital technology changing shopper behaviour, and the industry has been requesting an update.

So in late 2014 Popai and global research house, GfK, conducted an industry survey and series of interviews among more than 240 brand manufacturer, retailer, agency, and POP supplier professionals, with around half the sample from or specialising in the FMCG industry.

The results of the study will be presented here in Inside FMCG across six articles in a series:

- Executive summary: what’s changed and what hasn’t in the past three years?

- The brand manufacturer perspective on shopper marketing (including resourcing, budgets)

- The retailer perspective on shopper marketing (including resourcing, budgets)

- The agency perspective on shopper marketing and changes in the agency landscape

- Shopper marketing activation types including digital/mobile use in shopper marketing

- Where to from here? Vision for the future.

Below we summarise the gist of the survey outcomes, particularly what has and has not changed in the past three years.

When we did the first survey in 2010, the industry was still questioning the need for shopper marketing.

We have now collectively moved to a point where the need for shopper marketing is not in question, but rather what it will look like in the organisation and how it can best be strategically leveraged.

Brand manufacturers are increasingly building shopper into their planning processes, but for many retailers it remains a tactical function.

Agencies are feeling the pressure as brands abdicate some of their path to purchase strategy responsibility and retailers look to outsource post program evaluation.

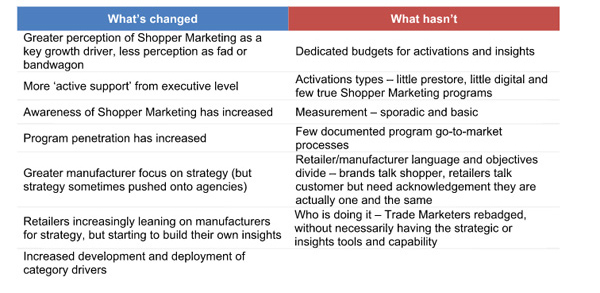

While the belief in and desire to utilise shopper marketing has increased, commitment and action remain fairly static as illustrated in the below table.

Shopper marketing is at a crossroads. Awareness has been built but not much of the ‘buy in’ to the discipline has been converted into discernible activity improvements.

The current momentum needs to be converted and integrated, but the full benefits of undertaking a shopper marketing approach are still not understood by many, and therefore senior leaders in some organisations are not fully engaged.

This is resulting in the industry being led by the change in shopper, and in shoppers’ behaviour, rather than the industry leading the change.

“The Unrealised Potential of Shopper Marketing” POPAI/GfK industry benchmark report is available from Popai for members for $395 and non-members for $995. For more information, click here.

Norrelle Goldring is head of shopper experience and retail performance at global retail research house GfK. Norrelle can be contacted on 0437 335 686 or email norrelle.goldring@gfk.com

Lee McClymont is GM of Popai Australia and New Zealand and has 15+ years’ industry experience in specialty retail, agency, and brand. Lee can be contacted on 0414 941 585 or email leem@popai.com.au.