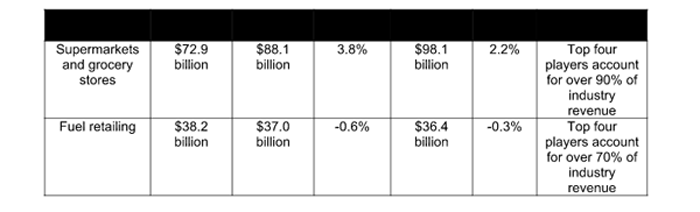

Australia’s supermarket and grocery stores and fuel retailing industries will generate an estimated $125.1 billion in 2015-16, and reach $134.5 billion by 2020-21, according to new data released by IbisWorld.

Australia’s supermarket and grocery stores and fuel retailing industries will generate an estimated $125.1 billion in 2015-16, and reach $134.5 billion by 2020-21, according to new data released by IbisWorld.

The traditional supermarket giants Coles and Woolworths currently account for more than 70 per cent of the supermarkets and grocery stores industry in Australia, and more than 40 per cent of the fuel retailing industry. But competitor Costco continues to gain ground, with the bulk-buying retailer growing its share of supermarket revenue.

According to IbisWorld, Costco already claims 1.2 per cent of this $88.1 billion dollar industry, with only seven stores. Costco’s ongoing diversification into the fuel retailing industry is expected to increase competition, with the company’s low-price strategy attracting motorists as customers have little brand loyalty in terms of fuel.

“The trading landscape for supermarkets and fuel retailing has changed considerably over the past three decades, with new entrants increasing competition and changing consumer preferences creating new challenges and opportunities,” said IbisWorld industry analyst, Brooke Tonkin.

Price competition

Supermarkets and grocery stores once operated alongside specialist food retailers, but now compete fiercely with specialist retailers on price and product range in a bid to attract shoppers.

IbisWorld says industry retailers such as Coles have recognised the importance of price competition by implementing substantial price cuts across their stores. Consumers have become increasingly price-conscious, and want to be assured that they are purchasing value for money goods.

Sales volumes generally remain relatively static for supermarkets, as shoppers tend to buy similar goods from week to week. As a result, price cuts have a significant effect on profit margins. To combat price competition and maintain profit margins, Woolworths has been forced to reduce costs.

“While supermarkets continue to compete on the basis of price, other factors such as convenience, product variety and quality have emerged as driving forces in securing customer loyalty. This helps explain the growth of Costco, which has steadily gained market share over the past five years,” Tonkin said.

The Costco model

Convenience has become a major factor in attracting customers, with major supermarket players attempting to broaden their ranges to include basic necessities as well as specialist gourmet products.

Meanwhile, Costco is attempting to increase its market share through the opening of new stores, and the sale of a diverse range of products in bulk. The expansion of new stores has been a major driver of Aldi’s growth, and similar success is expected for Costco, as the number of stores is a key competitive factor.

Costco offers a much wider range of products than the current supermarket duopoly at its seven Australian stores, including clothing, televisions, and other appliances. Costco’s bulk-buying power allows it to offer very low prices. The wholesaler is able to offer such large discounts on its products and remain profitable due to its annual membership fee of $60.

The majority of the company’s profitability comes from this fixed source of revenue, allowing it to pursue aggressive price competition. Costco’s earnings before interest and tax have only shown positive results once in Australia since 2009, indicating that the company is primarily focused on gaining market share in Australia. The membership fee also helps foster customer loyalty.

Store location is also important, and Coles and Woolworths have attempted to broaden their reach by expanding fuel station grocery offerings into mini supermarkets.

“Costco’s expansion into fuel retailing is in line with this trend, as the wholesaler plans to become a convenient one stop shop where customers can buy all their groceries and fill up on petrol in the one location,” Tonkin said.

Fuel retailing

The fuel retailing industry faces a high level of competition, as price and location largely determine where motorists buy petrol.

“Most consumers see petrol as an undifferentiated product and therefore purchase on price – there is effectively no brand loyalty,” Tonkin said.

The Costco fuel retailing strategy offers customers convenience and consistently lower prices, in line with the company’s grocery strategy. Costco’s establishment of a Moorabbin store with fuel pumps is a first in Victoria. The first Australian Costco fuel station was established in Liverpool, NSW, inNovember 2013.

The introduction of a fuel station at the Brisbane North Lakes store in May 2014 prompted a flurry of price cutting in the surrounding area, as other fuel retailers scrambled to compete with Costco’s low prices. However, Costco’s fuel prices remained lower than other retailers in the city, with customers saving up to 15 cents per litre. In the months following its opening, competition from Costco has continued to force down prices among other petrol stations in the area.

The way forward

As Aldi and Costco continue to expand in the supermarkets and grocery stores industry, the well established major players are expected to look for new ways to remain competitive and boost market share.

Woolworths announced in September 2015 that it would invest $65 million in store improvements and increasing staff hours. Meanwhile, Coles has already begun upgrading some of its larger stores to a new market-style format.

“These strategies are designed to keep shoppers instore for longer by presenting stores as foodie destinations, and attract greater sales through premium offerings such as ready-made meals and delicatessen products,” said Tonkin.

These new stores also offer patisserie goods, artisanal breads and even sushi bars. However, major competitor Aldi is also transitioning its stores to a market-fresh approach, with more fresh food, branded groceries, and ready to go and organic food. This is expected to further increase supermarket competition.