Multicultural consumers are providing a sizeable opportunity for Australian fruit and vegetable growers and retailers, with this group of shoppers expected to become even more important over the next few years, Nielsen analysts predict.

Multicultural consumers are providing a sizeable opportunity for Australian fruit and vegetable growers and retailers, with this group of shoppers expected to become even more important over the next few years, Nielsen analysts predict.

According to Nielsen’s latest insights into ethnic Australian households and their grocery shopping behaviours, the increasing immigrant population is influencing the cuisines Australians eat.

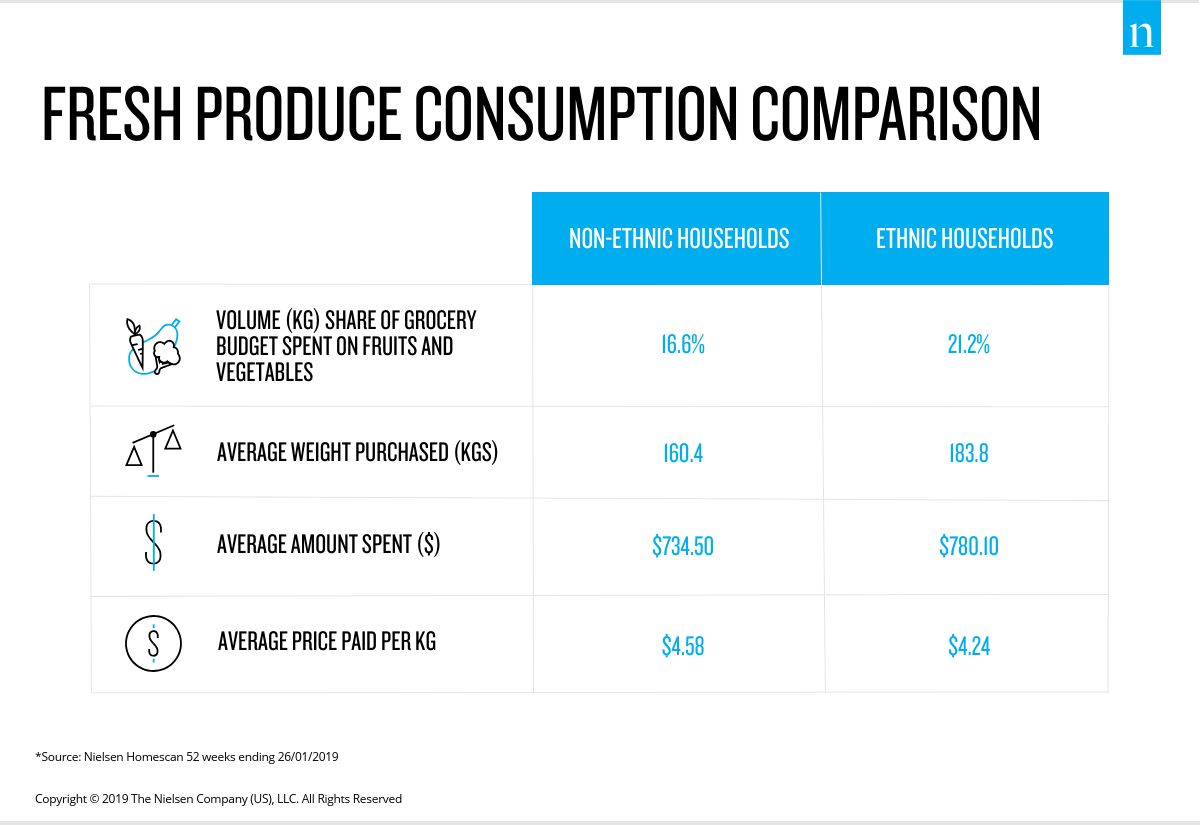

Ethnic households shop differently – particularly when it comes to fresh produce. These households allocate 21.2 per cent of their total grocery basket volume to fresh fruits and vegetables, compared to 16.6 per cent share for non-ethnic households, according to Nielsen.

Over the past year, ethnic households purchased on average 14.6 per cent more kilograms of fruits and vegetables and spent an additional $45.60 compared with non-ethnic households. However, ethnic households are thriftier, spending $0.34 less per kilogram on fresh produce.

“When thinking about our culturally diverse mix, we should no longer be focusing solely on European cultures. Today, Asian-born Australians now represent more than 10 per cent of the overall population – their footprint has more than doubled over the past 20 years

and this will continue to increase. Asian-born consumers are growing in importance and engaging with them requires a change in mindset,” said Chanel Day, associate director, Fresh Industry Lead, Nielsen.

“While there is a need to ensure that supply growth doesn’t overshoot demand, if the current rate of migration continues, we could expect to see steady demand growth for

even more fruit and vegetable categories that appeal to ethnic households. For example, winter melon, bitter melon, Chinese chives, daikon and tropical fruits all have future growth potential.”

A love for herbs, lychees and fresh leafy greens

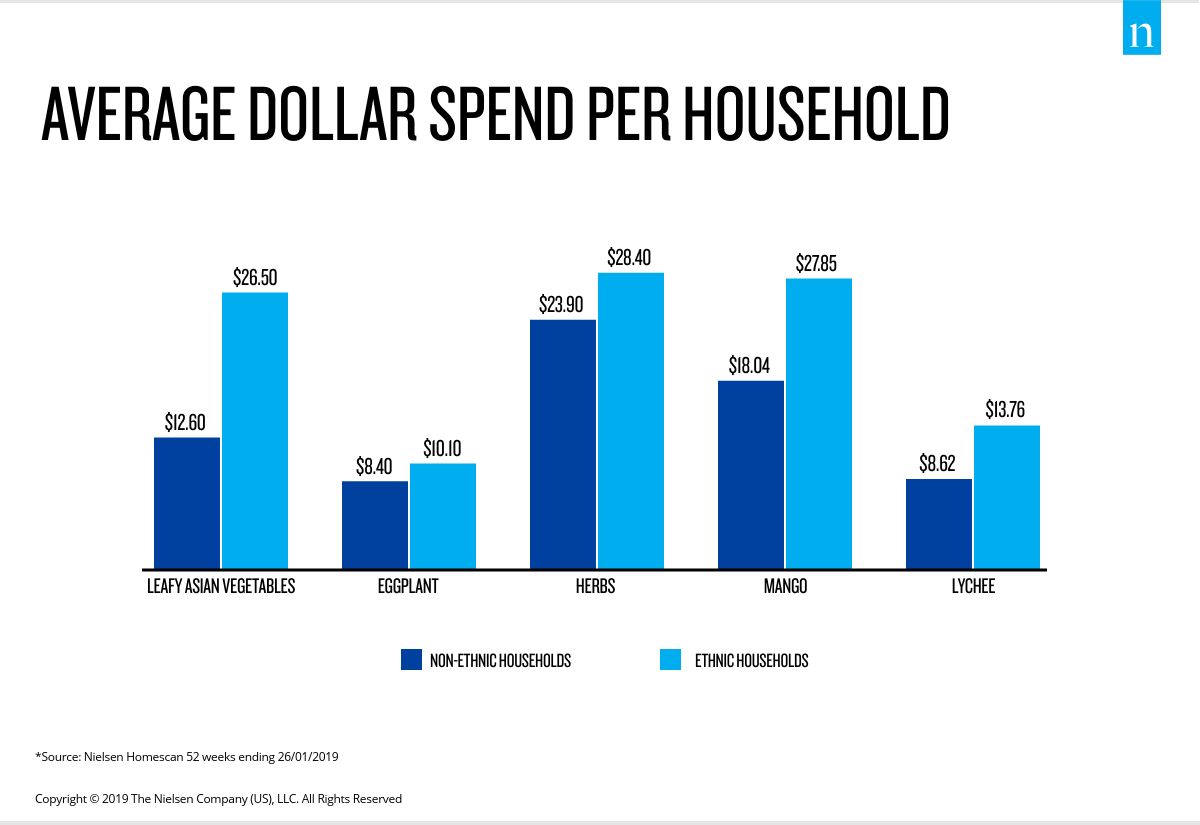

Studies show that ethnic households buy more leafy Asian vegetables, lychees, mango, eggplant and herbs in both volume and dollar terms in the past year compared to non-ethnic households. This finding makes the category more important for growers and retailers, who want to capture more opportunities from these culturally diverse households.

A preference for specialty stores

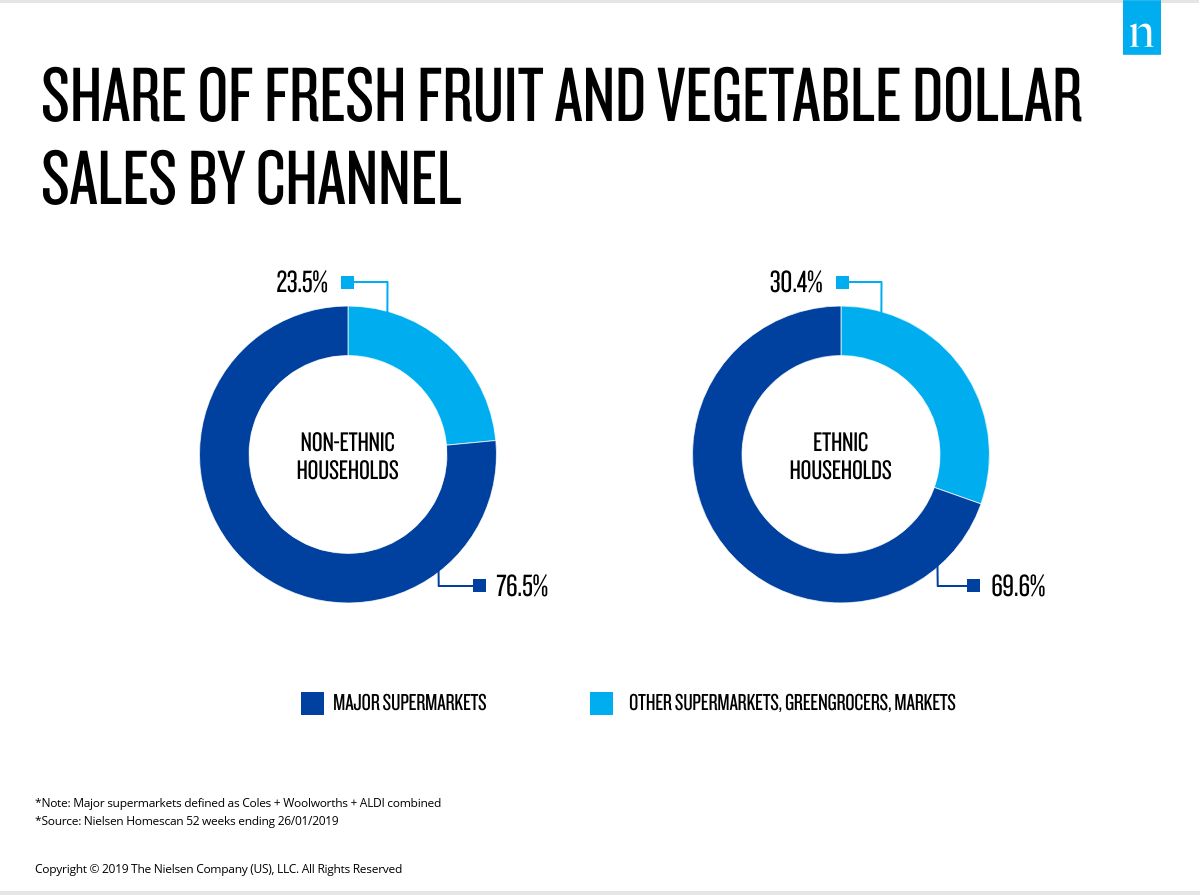

Nielsen found out that while most consumers shop for fresh fruits and vegetables in major supermarkets, ethnic households buy more from specialty stores such as Asian grocers, greengrocers and markets. Ethnic households also shop more frequently for fresh produce at speciality stores compared with non-ethnic households.

The opportunity for Australian growers and retailers

Furthermore, the research company found that ethnic households are more conscious with what they spend compared to non-ethnic households. This led to new product developments targeting ethnic shoppers that are supplied at a competitive price point to give the best chance of in-market success.