From milk and bread wars, it’s now roast chicken wars between the two supermarket giants, Coles and Woolworths.

From milk and bread wars, it’s now roast chicken wars between the two supermarket giants, Coles and Woolworths.

The latest findings from Roy Morgan Research show that 84.4 per cent of Australians consume chicken in an average week, outstripping the proportion who drink milk (77%) or eat bread/toast (70%) in the same period.

“Australians’ taste for chicken seems insatiable: according to the Australian Chicken Meat Federation, we eat an average of 46.2 kg per person per year,” said Norman Morris, Industry Communications director of Roy Morgan Research. “Roy Morgan data bears this out, showing that substantially more Aussies eat chicken in an average week (84.4%) than any other meat, well ahead of beef (74.2%), pork/ham/bacon (65.4%), fish (54%) or lamb (34.4%). So Coles and Woolworths certainly knew what they were doing when they chose roast chicken as the protagonist of their latest price war.”

What’s more, both supermarket giants’ shoppers have an even greater taste for chicken than the average Aussie: 89 per cent of people who mainly shop at Coles and 88.5 per cent of those who mainly shop at Woolworths eat chicken in any given seven days. Clearly, the supermarkets know their customers. (It should be noted that IGA and ALDI customers are above average for chicken consumption too, but not quite to the same extent).

But has the cheap roasted chicken at the two supermarkets had any impact on chicken fast food outlets? Are fewer people getting their roast chook from KFC, Red Rooster and the like, now that they can grab one when they’re doing their groceries?

“While it is too early to determine whether the roast chicken wars will have any lasting effect on visitation to fast food outlets like KFC or Red Rooster, it is certainly noteworthy that year-on-year figures have slipped,” said Morris. “Roy Morgan data shows consistent, albeit moderate, year-on-year declines in visitation to fast food chicken outlets, among the general population as well as Coles and Woolworths shoppers.

“Admittedly, the decline has been slight, but the fact that it is evident across the main players must surely give pause for thought, as must the downturn among Coles and Woolies shoppers who visit fast food chicken outlets. If the price is right, why wouldn’t people buy a cheap roast chicken while they’re at the supermarket instead of making a special trip?”

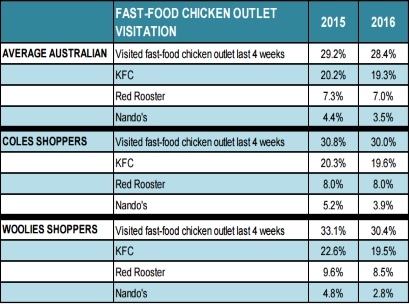

Aussies visiting fast food chicken outlets: 2015 vs 2016

In the past 12 months to June 2015, 29.2 per cent of Australians visited at least one fast food chicken restaurant in any given four weeks; by June 2016, this had inched down to 28.4 per cent. As the table above indicates, this decline is evident for the main fast food chicken players, KFC and Red Rooster, as well as for smaller chain Nando’s.

The fast food chicken downturn is also evident among Coles and Woolies shoppers, with the latter seeing the more noticeable decline, falling from 33.1 per cent to 30.4 per cent. Coles shoppers who go to fast food chicken joints have slipped from 30.8 per cent to 30 per cent.

“To survive in such a competitive market, marketers and retailers of roast chicken must have a thorough understanding of consumers’ dietary preferences and how these relate not only to their fast food and supermarket visitation, but their attitudes to food and health more generally,” Morris commented.