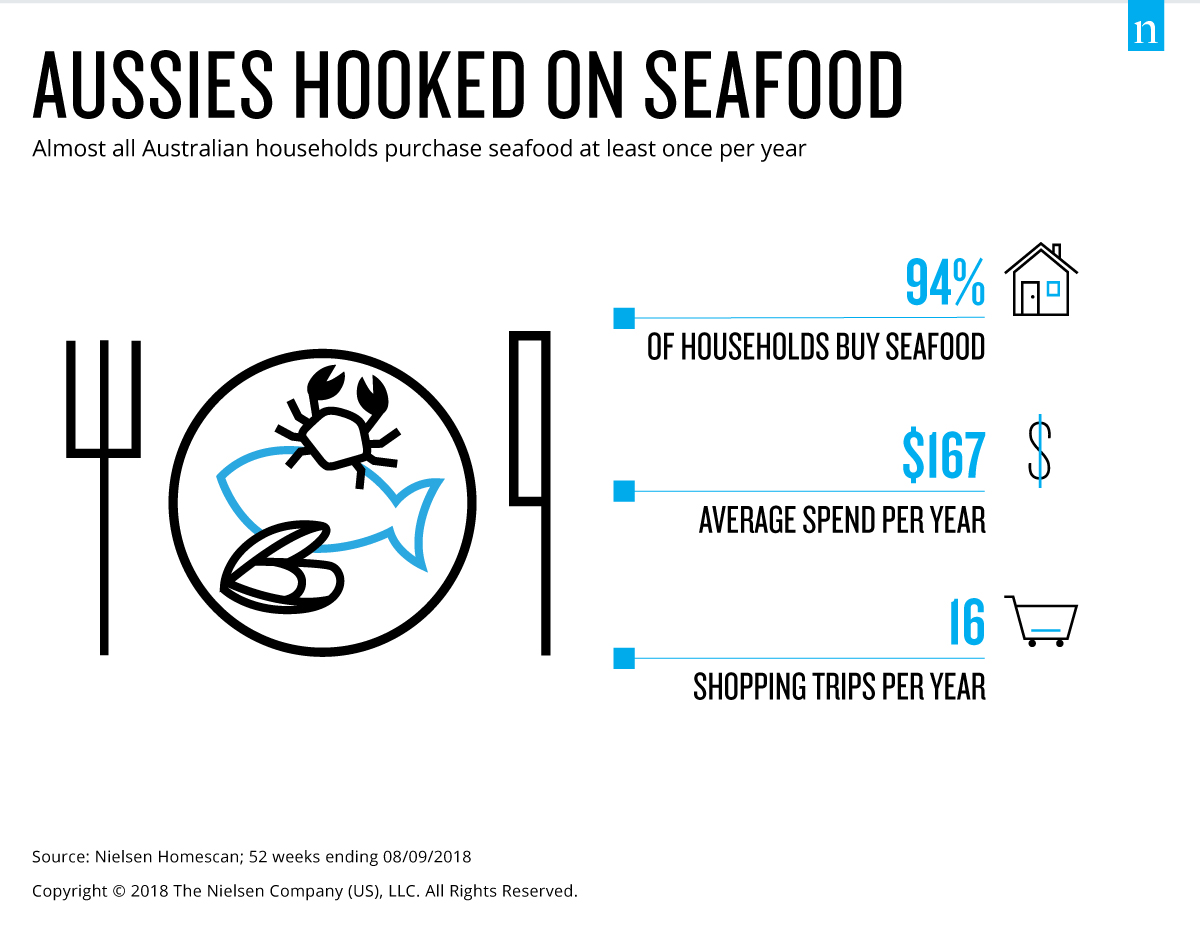

Australian shoppers are hooked on fish. In the 52 weeks ending 8 September 2018, more than nine-in-ten (94%) Aussie households have purchased some type of fish or seafood.

Australian shoppers are hooked on fish. In the 52 weeks ending 8 September 2018, more than nine-in-ten (94%) Aussie households have purchased some type of fish or seafood.

These households spent an average of $167 split across 16 shopping occasions in the last 12 months. Total annual dollar sales for the fish and seafood category grew by 3.6%, largely driven by an increase in the average price per kilo; and in volume terms, the amount of fresh seafood purchased by consumers in the past year has held steady.

The fish and seafood category is well-positioned to be a premium protein offer for consumers. Fresh fish accounted for half of all dollar sales for the category in the past year, while frozen and ambient each made up a quarter. This highlights how important fresh seafood is when it comes to driving up the value of the category overall, although most shoppers buy across all three segments.

Fish and seafood seasonality

Having the right supply is critical during key seasonal times. While some species, such as salmon, are sold consistently throughout the year; prawns have a seasonal skew with sales peaking over Christmas and Easter. Once the festive season is over and consumers reign in their eating and drinking, the category typically sees a surge in the cheaper ambient and frozen seafood options.

Fresh fish finding growth in supermarkets

Traditionally, fishmongers and markets have been perceived as the stronghold of fresh seafood sales. However, this dynamic is changing. Major supermarkets are driving the growth of fresh fish and seafood, while specialty shops and markets as a retail group are declining. In 2018, 79% of Australians shoppers purchased their fresh fish from the supermarket, compared to 21% who purchased from specialty shops and markets.

Freezer leads growth

Contrary to other proteins such as meat and poultry, frozen fish and seafood are growing faster than both the fresh and ambient segments. Last year, frozen fish grew by 5.3% in dollar sales and 3.3% in volume sales, with some of this increase in volume attributed to shoppers switching from fresh to frozen.

Frozen fish and seafood has a wide range of prepared options and a lower price point that appeals to busy families and also those in a lower income bracket. Over the past year, the frozen segment was, on average, $10 cheaper per kilogram than fresh fish and seafood. The frozen segment has also had a significant amount of new products launched over the past year (particularly in the area of frozen white fish and prawns) contributing more than $10 million to the category.

Atlantic salmon, barramundi and prawns were the biggest contributors to value growth within fresh fish and seafood. All these species have also experienced significant growth with modified atmosphere packaging (MAP) – a highly effective method for extending the shelf-life of produce. MAP packaged fish and seafood delivered just under half of the fresh fish and seafood dollar growth, with MAP salmon recording a significant amount of success in 2018.

Ambient category fish – tinned or other shelf-stable varieties – is a consistent performer featuring in the lunches and dinners of many Australians on a regular basis. Unsurprisingly, most ambient fish is sold through supermarkets with 90% of the value going through this channel. Salmon, tuna and sardines are the key contributors to growth in this segment. Ambient has the cheapest price per kilo of the segments; perhaps one of the reasons these products have a strong skew toward young, single Australians.

Ethnic diversity represents important growth opportunity

In 2016, the number of people born overseas, or who had at least one parent born overseas, made up almost half (49%) of the entire population. This group represents an important opportunity for seafood, as these ethnic shoppers spend more when they buy fresh fish and seafood than non-ethnic shoppers. Ethnic shoppers are not as fond of Atlantic salmon as Australian shoppers; but they do show a marked preference for barramundi. Fresh fish is also skewed toward couples over 35 who fall into a higher income bracket.

Australians are currently also showing a much higher engagement with health and wellness trends; and fish and seafood are ideally poised to take advantage of these trends. Millennials and high income households, in particular, have a greater willingness to pay a premium for products that have perceived health benefits or offer superior quality such as fish and seafood.

Melanie Norris is the Senior Manager for Retail at Nielsen Australia.