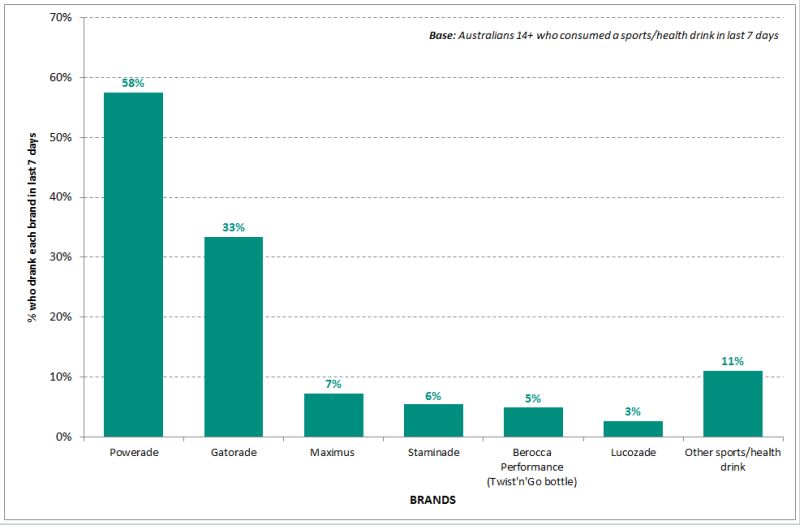

The Australian sports drink market is currently dominated by global giant, Powerade, according to new data by Roy Morgan, with Powerade drunk by more than half (58 per cent) of sports drink consumers in an average seven days.

According to the latest findings from Roy Morgan Research, eight per cent of the population consume sports drinks such as Powerade, Gatorade, and Staminade in any given seven days.

Powerade’s long time rival, Gatorade, is chosen by 33 per cent of people who drink these beverages, while Australasian brand, Maximus, is a distant third at seven per cent, however, a certain portion of each brand’s consumers drink at least one other brand during the same time period.

Twice as many men (10 per cent) as women (five per cent) drink these beverages, while young Aussies aged under 25 (14 per cent) are more likely to consume them than any other age group.

“The Australian sports drink market is currently dominated by global giant Powerade, with even its closest competitor Gatorade 25 per cent behind,” Andrew Price, GM – consumer products, Roy Morgan Research, said.

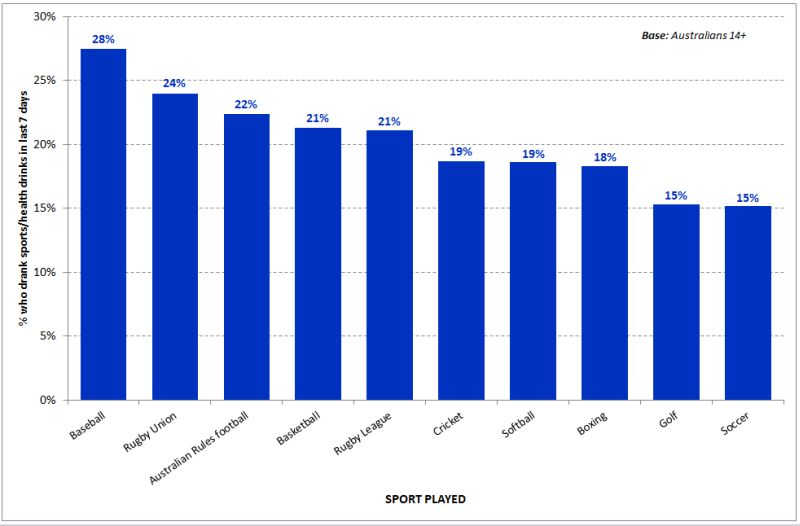

“While our data does not tell us whether sports drinks actually improve sporting performance, it does reveal that people who practice sport are much more likely than the average Australian to consume them. Some brands have an even stronger sporting connection through sponsorship arrangements, such as Powerade’s partnership with the NRL and Gatorade’s association with Cricket Australia and the AFL.

“While it is difficult to imagine how Powerade’s dominance of the Australian market could be challenged, brands must at least ensure their competitive edge by understanding their present and future consumers’ demographics, behaviours, and attitude.”

Australia’s most popular sports drinks

The champion’s choice?

In addition to the ‘fitspiration’ that characterises much of its marketing, the sports drink category distinguishes itself from other non-alcoholic beverages (carbonated soft drinks and energy drinks, for example) by emphasising its sports science credentials such as special formulas, isotonic qualities, and electrolytes, and this has not gone unnoticed, according to Roy Morgan.

In fact, people who play sport are noticeably more likely to drink sports drinks than the average Aussie. For instance, 28 per cent of people who play baseball, 24 per cent of those who play rugby union, and 22 per cent of those who play Australian Rules football consume at least one of these beverages in any given seven days – all well above the national average (eight per cent).

Sportspeople most likely to drink sports drinks

Source: Roy Morgan Single Source (Australia), April 2014 – March 2015 (n=15,913)