Cider is not only the country’s fastest growing alcoholic beverage, but its consumption spikes dramatically during the summer months, according to Roy Morgan’s latest research.

Cider is not only the country’s fastest growing alcoholic beverage, but its consumption spikes dramatically during the summer months, according to Roy Morgan’s latest research.

Between 2006 and 2016, the number of Aussie adults who drink cider in an average four weeks has sky-rocketed by almost 600 per cent from just 337,000 to 2,349,000.

The only other alcoholic beverage to have gained popularity over the same period was spirits, which saw a more moderate growth of 25 per cent.

“Since we first revealed cider’s popularity boom in the wake of the government’s increased tax on ‘alcopops’ (premixed spirits), its upward trajectory has been nothing short of remarkable,” said Norman Morris, industry communications director of Roy Morgan Research.

“The number of Aussie adults drinking cider in an average four weeks has now well and truly surpassed those drinking alcopops in the same period (2,025,000) and shows no sign of plateauing. In fact, with summer upon us, Roy Morgan data shows that cider consumption is on the verge of its annual spike.”

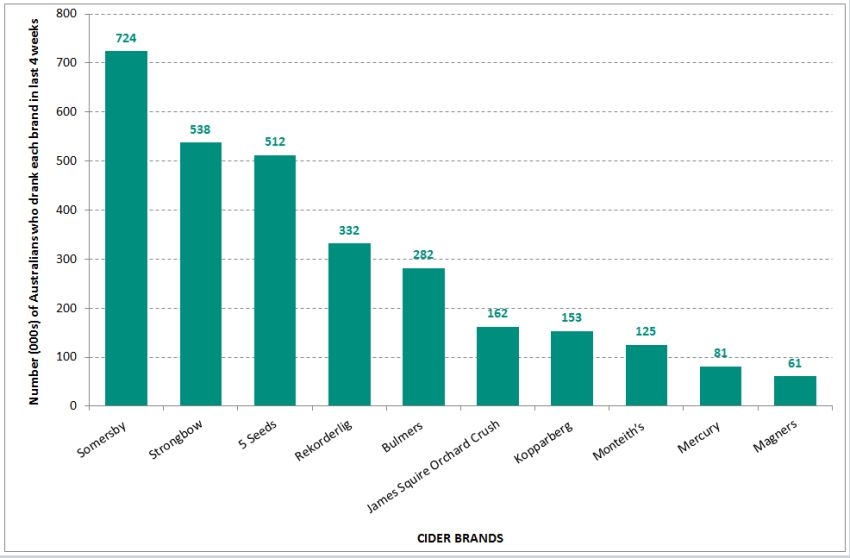

With some 724,000 Aussie adults drinking it in an average four weeks (up from 460,000 in 2015), Somersby cider leads the field by a long shot, having overtaken last year’s most popular cider brand 5 Seeds (512,000, up from 506,000).

5 Seeds was also pipped at the post by old favourite Strongbow (538,000), which has bounced back from a slump of several years. Rekorderlig (332,000) and Bulmers (282,000) complete the top five, although both of these brands lost consumers over the last 12 months (Rekorderlig is down from 435,000 drinkers per four-week period and Bulmers declined from 312,000).

Australia’s 10 most popular cider brands

Source: Roy Morgan Single Source (Australia), Oct 2015-Sept 2016, n=14,489. Base: Australians 18+

While cider is very much a younger person’s drink, with just over half (52.7%) of Australia’s cider consumers being under 35 years old, cider drinkers of all ages share some striking similarities in terms of their attitudes and behaviour.

“What’s more, Roy Morgan data shows that cider drinkers have an elevated tendency towards novelty, whether that be in the form of new experiences or new alcoholic beverages, which would make maintaining consumers’ interest for any length of time a little more challenging for brands,” said Morris.