We’ve discussed in previous articles in the series how Popai/GfK Shopper Marketing Industry Survey respondents told us that retailers look to agencies for insights and creative program ideas, and manufacturers look to agencies for shopper and purchase journey strategy, as well as creative program ideas.

We’ve discussed in previous articles in the series how Popai/GfK Shopper Marketing Industry Survey respondents told us that retailers look to agencies for insights and creative program ideas, and manufacturers look to agencies for shopper and purchase journey strategy, as well as creative program ideas.

Here we’re going to look at what this means for what’s actually making it into market.

Where does shopper sit in the strategic planning process?

The number of brand manufacturers and retailers claiming to run shopper marketing planning simultaneous to other plan types has increased from 31 per cent in 2011 to 45 per cent in 2014, and this has come from the decrease in those with no strategic shopper plans (33 per cent in 2011 compared to 24 per cent in 2014).

Only 16 per cent have shopper plans at the beginning of the annual planning process. For manufacturers a similar number still have their shopper plans driven out of brand planning.

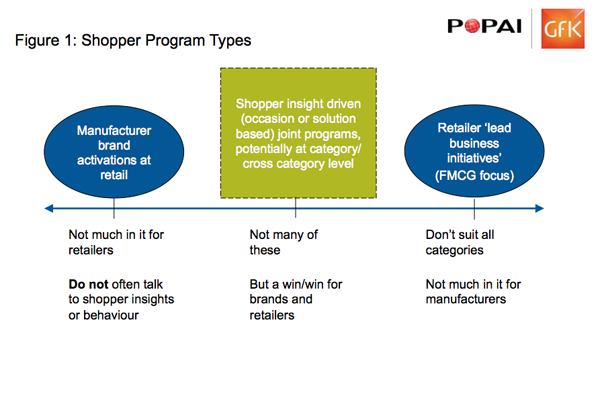

For manufacturers, there is still a tendency for category and shopper plans to be retrofitted to brand plans and post-rationalised, and this is impacting the types of shopper programs being pitched to retailers (see Fig 1). Retailers are more likely than manufacturers to only have tactical, and no strategic plans.

The earlier shopper is planned for, the greater the chance it will become more strategic and increase the chance of investment, however, so will the expectations of its returns increase, and thus subsequent requirement for proof sources and innovation.

In getting shopper activations into market, there is a set documented go to market process for only one third of manufacturers, only half of agencies, and virtually no retailers – potentially because retailers may rely on manufacturers for shopper activation and getting materials to store.

The lack of documented process yet successful execution is a reflection of the same trade marketing people being rebadged. The processes sit with them rather than with the organisation. There is thus a risk is that this IP leaves with the people.

There is a need to centrally document and embed a standardised process for in- market activation so that it is efficient, effective, and clearly understood by all parties, irrespective of who is implementing it, however the trade marketing rebadged effect is also resulting in a relatively small shift in the types of programs getting into market, as the mindset behind those executing remains the same in a number of cases.

The program type paradox

There is a split of program types, where manufacturers push brand messaging and brand activations in the retail space at one end of the continuum, particularly in channels where the retailers are less sophisticated and look to brands for best practice, and at the other end retailers encourage participation in lead business initiatives which are often not shopper insight driven and don’t apply to all categories. (See Fig 1 below).

Few true shopper marketing programs are thus making it into market. Non-shopper oriented programs risk irrelevance and thus wasted spend as shoppers are emerging to have the real power.

True shopper marketing programs require a new approach and parties coming together to really understand the needs of the shopper to find value adding solutions that meet everyone’s needs.

What tools and techniques are being used?

Because of the brand-centric or retailer-centric, rather than shopper-centric, approaches to shopper marketing programs, not much has changed in the area of tools and techniques used since our 2011 industry survey.

The top five most frequently used techniques and touch points are still the traditional ones, point of- ale, off location displays, catalogues, sampling or demonstrations, and websites (see Fig 2 below).

Social media is making inroads, but mobile, interactive, augmented reality, and virtual reality are either non-core or in their infancy.

The industry’s slow take up of digital touch points for shopper marketing programs lags shoppers’ omni-channel behaviour and use of mobile devices for shopping.

Next week we’ll look further at what survey respondents told us is and isn’t happening in the digital shopper marketing space, and who plans to do what about it.

The Unrealised Potential of Shopper Marketing Popai/GfK industry benchmark report is available from Popai for members for $395 and non-members for $995. More information at www.popai.com.au.

Norrelle Goldring is head of shopper experience and retail performance at global retail research house GfK. Norrelle can be contacted on 0437 335 686 or email norrelle.goldring@gfk.com

Lee McClymont is GM of Popai Australia and New Zealand and has 15+ years’ industry experience in specialty retail, agency, and brand. Lee can be contacted on 0414 941 585 or email leem@popai.com.au.